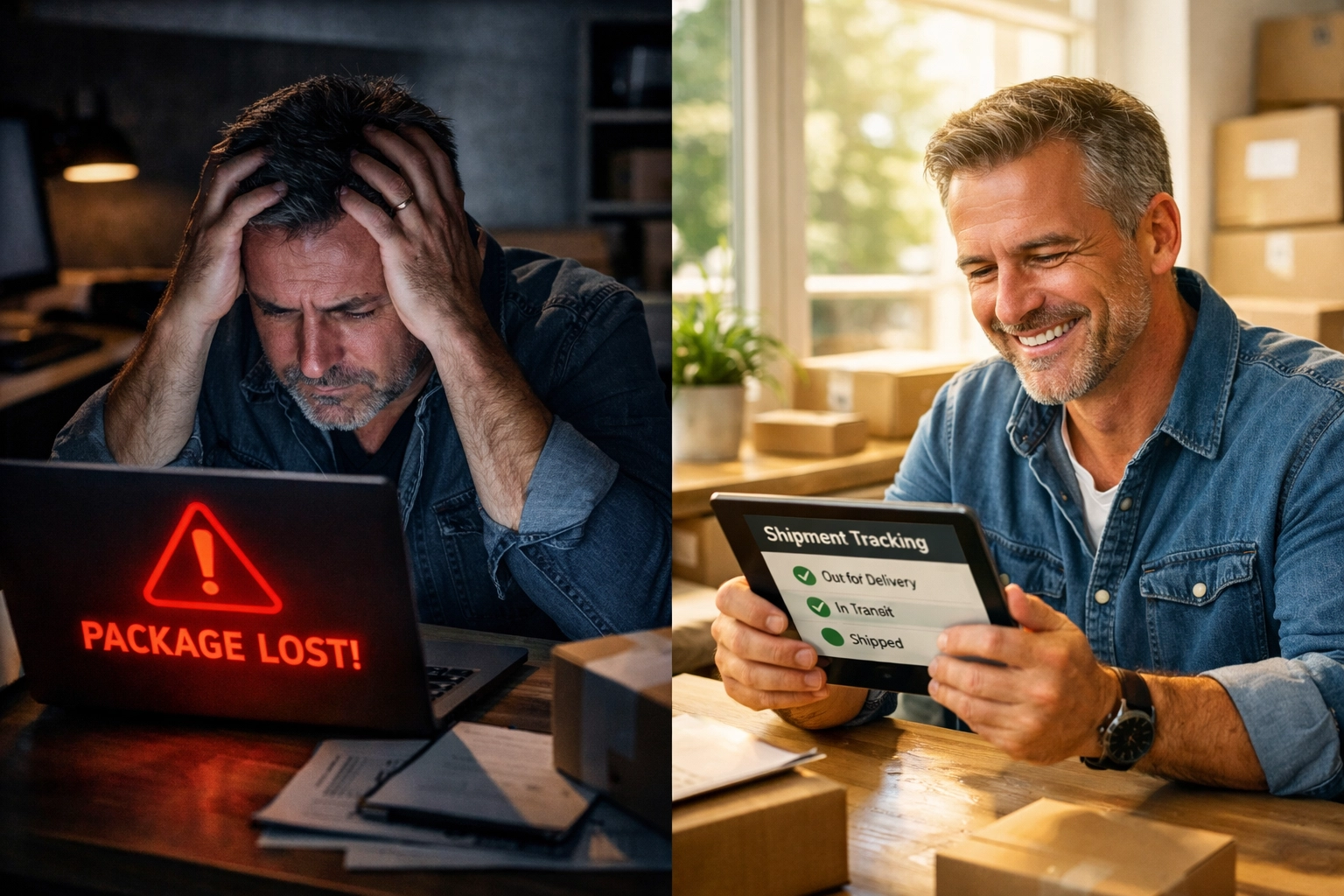

Here's a scenario that keeps business owners up at night: You've just shipped a £5,000 order of premium electronics to a client. Three days later, you get the dreaded email: the package never arrived. Or worse, it arrived damaged beyond repair.

In today's high-stakes shipping landscape, a single lost or damaged high-value package can wipe out weeks of profit, damage your reputation, and leave you scrambling to make things right. And here's the kicker: that £100 standard coverage your carrier provides? It won't even come close to covering your loss.

That's why shipping insurance for high-value items isn't just a nice-to-have anymore: it's essential protection for any business handling valuable goods in 2026.

Why Standard Carrier Coverage Falls Dangerously Short

Most businesses assume they're covered when they hand over a package to their courier. Unfortunately, that assumption can be a costly mistake.

Standard carriers like UPS, FedEx, and Royal Mail typically include automatic coverage of around £100 per shipment. While that might protect your average parcel, it's laughably inadequate for high-value items like jewellery, electronics, industrial equipment, or luxury goods.

The gaps in standard coverage are significant:

- Minimal liability limits: That £100 cap means you're personally absorbing losses on anything above that threshold

- Exclusions galore: Many carriers exclude certain item categories or damage types from their basic coverage

- Claim complexity: Filing claims with standard coverage often involves mountains of paperwork and lengthy disputes

- No replacement guarantee: Even if your claim is approved, the process can take weeks or months

When you're shipping items worth hundreds or thousands of pounds, relying on basic carrier liability is like bringing a butter knife to a sword fight. You're simply not equipped to handle what could go wrong.

What Shipping Insurance Actually Protects Against

Understanding what parcel delivery with insurance covers helps you see why it's worth the investment. Comprehensive shipping insurance protects your business from the full spectrum of transit disasters:

Loss and theft: If your package disappears entirely: whether stolen from a depot, misdelivered to the wrong address, or lost in transit: you're covered for the full declared value.

Physical damage: Dropped packages, crushed boxes, water damage from weather exposure, or mishandling during sorting: all these scenarios are covered when standard carriers might argue over liability.

Customs issues: For international shipments, insurance can protect against losses during customs inspections or delays that result in spoilage for time-sensitive goods.

Mysterious disappearances: Sometimes packages just vanish without explanation. Insurance removes the guesswork and financial stress from these situations.

The real value isn't just financial: it's operational. When you know your shipments are protected, you can focus on growing your business instead of worrying about every package in transit.

Who Absolutely Needs High-Value Shipping Insurance

Not every business ships the same types of goods, but certain operations simply cannot afford to operate without comprehensive coverage.

You need shipping insurance if you're handling:

- Electronics and tech equipment: Laptops, smartphones, servers, and specialized equipment with values exceeding £500 per item

- Jewellery and precious metals: Watches, rings, necklaces, or raw precious materials where replacement costs are steep

- Luxury goods: Designer fashion, collectibles, art, or high-end accessories with significant markup

- Industrial components: Specialized machinery parts, precision tools, or manufacturing equipment

- Medical devices: Diagnostic equipment, prosthetics, or pharmaceutical supplies requiring careful handling

Volume matters too. If you're shipping 3-5 or more high-value packages daily, a single loss without insurance could devastate your monthly profit margins. The math is simple: the premium you pay for insurance is always less than the cost of replacing even one lost shipment out of pocket.

The Financial Reality: Third-Party vs. Carrier Insurance

Here's where things get interesting. Not all shipping insurance is created equal, and choosing the right provider can save you serious money.

Third-party shipping insurance typically offers better value than point-of-sale carrier coverage: sometimes up to 50% cheaper. That's not a typo. Because third-party insurers specialize in this coverage, they can offer broader protection at lower rates than carriers who treat insurance as an add-on service.

The cost-benefit breakdown:

- Carrier insurance: Often charges 2-3% of declared value, with strict limits and exclusions

- Third-party insurance: Typically 1-2% of value, with more comprehensive coverage and faster claims processing

- Self-insurance (no coverage): Zero upfront cost, but 100% exposure to losses that can exceed £10,000+ per incident

When you factor in the claims experience, third-party options become even more attractive. Dedicated insurance providers have streamlined claims processes, faster payouts, and customer service teams that actually understand high-value logistics.

How We Handle High-Value Shipments at Global Corporate Logistics

At Global Corporate Logistics Limited, we've built our reputation on getting valuable cargo where it needs to go: intact, on time, and with full transparency throughout the journey.

Our approach to high-value shipping combines protection with performance:

24/7 shipment tracking: You'll always know exactly where your valuable items are, with real-time updates from collection to delivery. This visibility isn't just convenient: it's essential for identifying potential issues before they become problems. Check out our efficient parcel delivery network to see how we maintain constant oversight.

Tailored insurance solutions: We don't do one-size-fits-all. Whether you're shipping a £500 laptop or a £50,000 piece of industrial equipment, we'll structure coverage that matches your specific needs and risk profile.

Expert packaging guidance: Insurance only works if your items arrive in claimable condition. Our packaging solutions ensure that high-value goods are properly protected from the moment they leave your facility.

Customs clearance expertise: International high-value shipments face additional scrutiny at borders. Our customs clearance specialists navigate documentation requirements to prevent delays that could jeopardize your coverage.

We've seen too many businesses learn about insurance gaps the hard way. That's why we build protection into every quote, every route, and every shipment we handle.

Real-World Scenarios Where Insurance Saves the Day

Let's talk specifics. Here are actual situations where comprehensive shipping insurance meant the difference between a minor hiccup and a business catastrophe:

The electronics retailer: A UK-based tech company shipped 20 high-end gaming laptops worth £30,000 to a distributor in Dubai. During transit, rough handling damaged 5 units beyond repair. With insurance, they received a £7,500 payout within 10 days and maintained their client relationship. Without coverage, they would have absorbed the full loss and likely lost the account.

The jewellery designer: A small luxury brand sent a collection worth £15,000 to a trade show in New York. The package was misdelivered and never recovered. Insurance covered the full replacement cost, allowing them to create new pieces and still attend the show. The alternative? Missing the event entirely and losing months of networking opportunities.

The industrial supplier: Specialized manufacturing equipment valued at £50,000 was damaged during international shipping. The standard carrier coverage offered £100. Comprehensive insurance paid the full claim, preventing a complete operational shutdown for the receiving company.

These aren't edge cases: they're Tuesday afternoon in the logistics world. The only difference between a resolved problem and a business disaster is whether you had proper coverage in place.

Making the Insurance Decision in 2026

The shipping landscape has changed dramatically. E-commerce growth, supply chain complexity, and rising cargo theft have all increased the risks of moving high-value goods. In this environment, asking "Can I afford insurance?" is the wrong question.

The right question is: "Can I afford NOT to have insurance?"

Calculate your exposure by looking at:

- Average value per shipment × number of monthly shipments = total at-risk capital

- Historical loss rate in your industry (typically 0.5-2% of shipments)

- Replacement costs including rush production, expedited shipping, and customer compensation

For most businesses shipping high-value items, the annual insurance premium represents less than one month's profit: while a single uninsured loss could wipe out an entire quarter's earnings.

We help businesses make these calculations every day. The data consistently shows that insurance pays for itself by preventing just one or two incidents per year.

Beyond Insurance: The Complete Protection Strategy

While insurance is non-negotiable, it works best as part of a comprehensive protection strategy. At Global Corporate Logistics, we recommend layering multiple safeguards:

Route optimization: Some shipping lanes carry higher risk than others. We analyze routes for theft hotspots, handling requirements, and weather patterns to minimize exposure before packages even leave the warehouse.

Carrier selection: Not all carriers handle high-value goods with the same care. We match shipments to carriers with proven track records for your specific item category and destination.

Documentation excellence: Proper paperwork prevents disputes. We ensure every shipment has accurate declared values, detailed contents descriptions, and photographic evidence of pre-shipping condition.

Recipient verification: For extremely high-value items, we arrange signature-required delivery with ID verification to eliminate misdelivery risks.

This multi-layered approach means your insurance works as the safety net it's designed to be: rarely needed, but absolutely critical when circumstances go wrong.

Frequently Asked Questions

How much does shipping insurance for high-value items typically cost?

Insurance costs generally range from 1-3% of the declared shipment value, depending on the item type, destination, and coverage level. For a £1,000 shipment, expect to pay £10-30 for comprehensive coverage. Third-party insurance often costs 40-50% less than carrier-provided options while offering better protection.

What happens if my insured package is lost or damaged?

File a claim immediately with documentation including photos, receipts, and tracking information. Most insurers process claims within 10-15 business days for straightforward cases. We guide our clients through this process to ensure quick resolution and payment.

Does insurance cover customs seizures or delays?

Standard insurance typically doesn't cover customs-related issues unless goods are damaged during inspection. However, specialized policies can include coverage for confiscation due to documentation errors (not illegal goods). We help ensure proper customs documentation to minimize these risks in the first place.

Are there items that can't be insured for shipping?

Most insurers exclude cash, live animals, perishable goods without refrigeration, and illegal items. Some restrict coverage on extremely high-value items (over £100,000) or require additional underwriting. We'll identify any restrictions during the quoting process.

Can I adjust coverage amounts for different shipments?

Absolutely. Coverage should match the actual value of each specific shipment. We adjust coverage dynamically based on what you're shipping: no need for fixed annual policies that might over or under-protect individual parcels.

Ready to protect your high-value shipments? Contact Global Corporate Logistics today to discuss tailored insurance solutions and reliable worldwide shipping. With 24/7 tracking and expert logistics support, we'll ensure your valuable cargo arrives safely( every single time.)